Debt is a pivotal element of finance, influencing the functioning of corporations, economies, and nations. Acquiring a thorough understanding of debt and its maturity profile is crucial as it assists in making informed decisions. In this guide, we will delve deep into the complexities of debt maturity and provide a comprehensive understanding.

The Essence of Debt Maturity Profiles

The debt maturity profile refers to the duration until a debt instrument reaches maturity and becomes due for repayment. This profile is a vital aspect of debt management, as it furnishes investors and businesses with a clear understanding of the timing of repayments. Having knowledge of the debt maturity profile can help businesses plan their finances and avoid potential cash flow difficulties.

The Importance of Debt Maturity Profiles

The debt maturity profile is significant as it impacts a corporation’s financial stability and ability to repay its debts. Companies with long debt maturity profiles may face difficulties repaying their debts, as they have to wait longerbefore they can repay their creditors. Conversely, companies with short debt maturity profiles tend to have more financial stability. This is because they have to repay their debts more frequently, which helps to prevent cash flow difficulties.

Determining Debt Maturity Profiles

The date of issuance, the date of maturity, and the frequency of repayments, establish the debt maturity profile. Debt maturity length can range from a few days to several decades, based on the debt instrument and the terms.

Assessing Debt Maturity Risks

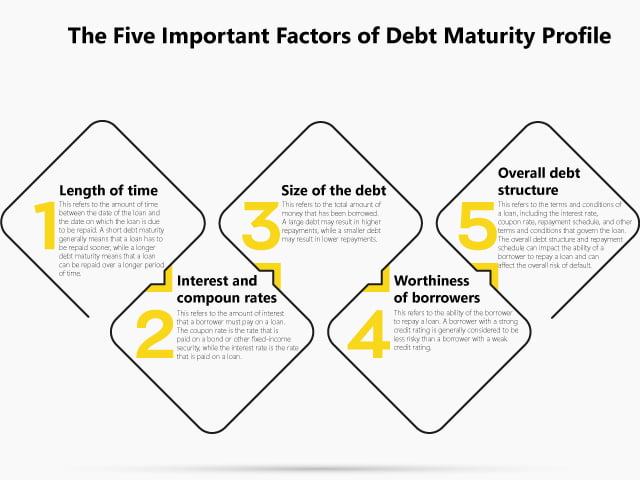

In-Depth Analysis When analyzing the debt maturity profile of a corporation, investors and lenders are concerned with the risk of default. To assess this risk, they must consider several crucial factors, which provide insight into the financial stability and creditworthiness of the borrower. In this section, we will explore each of these factors and how they play a role in determining the risk:

The Risk of Time to Debt Maturity

The timing of when a debt reaches maturity is a critical aspect in identifying the potential risk. As a general rule, a longer time-frame before maturation reduces the danger of default, as a company has more time to produce income and pay off its debts. Thus, making it less probable for the company to be unable to repay the obligation when it becomes payable. Conversely, a shortened maturation timeline enhances the risk, as a company has less time to generate revenue.

The Size of the Debt

The size of the debt is another crucial factor in evaluating the risk involved with a debt’s maturity profile. An enterprise with a significant debt load is more prone to financial distress. This is because large debt loads can constrict a company’s ability to make investments in growth and produce revenue, making it harder for the company to pay off its debts when they become due.

The Interest and Coupon Rates of the Debt

The interest rate and coupon rate on the debt are also crucial in evaluating a debt’s maturity profile. Typically, a higher interest rate or coupon rate signifies a higher risk of default. Conversely, a lower interest rate or coupon rate signifies a lower risk of default as it makes it less expensive for a company to repay its debts.

The Timing of Obligation Maturation

The timing of when a debt reaches maturity is critical in identifying the potential risk involved with the debt’s maturity profile. As a general rule, a more extended time-frame before maturation reduces the danger of default. Thus, making it less probable for the company to be unable to repay the obligation when it becomes payable.

The Magnitude of the Debt

The size of the debt is another crucial factor in evaluating the risk involved with a debt’s maturity profile. An enterprise with a significant debt load is more precarious than a company with a smaller debt load. This is because large debt loads can constrict a company’s ability to make investments. Generally, it makes harder for the company to pay off its debts when they become due.

The Overall Debt Arrangement and Repayment Plan

The overall debt arrangement and repayment plan are also significant in evaluating the risk involved with a debt’s maturity profile. For instance, an enterprise with a high volume of short-term debts is more likely to default than a company with a smaller volume of long-term debts, as it may struggle to produce enough revenue to pay off its debts when they become due. In the same vein, an enterprise with an irregular repayment plan is more likely to default than a company with a consistent repayment plan, as it may struggle to generate enough revenue to repay its debts when they become due.

The Benefits of a Long Debt Maturity

A long debt maturity has several advantages for a company, which can greatly benefit its financial stability and long-term success. Some of the key benefits of a long debt maturity are:

More Predictable and Stable Debt Repayment Obligation

A long-term debt profile offers a more predictable and stable debt repayment structure. With a wider time horizon, a company can anticipate when its debt payments are due and make preparations accordingly. It makes easier to regulate cash flow and guarantee that debts are paid on time.

Minimal Near-Term Payment Costs

Long-term debt commonly has a lower interest rate, which leads to decreased debt service payments in the short term. Hence, for corporations looking to limit their short-term debt repayment costs, a long debt maturity profile can be a favorable option.

Insulation from Interest Rate and Inflation Risk

A long debt maturity profile reduces a company’s vulnerability to interest rate and inflation fluctuations. This is because long-term debt is often linked to a fixed interest rate, which protects the company from increasing interest rates and inflation. On the other hand, short-term debt is usually connected to a floating interest rate, making it more susceptible to interest rate and inflation fluctuations.

Time to Strengthen Finances and Repay Debt

A long debt maturity profile gives a corporation more time to augment its finances and repay debt. With a longer time horizon, a company has more time to allocate resources, generate income, and build financial reserves. Thereby enhancing its ability to pay off its debts and maintain financial stability in the long run.

The Advantages of a Short Debt Maturity

Debt maturation can be a double-edged sword for companies, and short debt maturation has its own benefits, including:

Frequent Obligatory Repayments

A standout benefit of short debt maturation is more frequent repayment obligations. This means that a company must pay back its debts at regular intervals, which helps maintain a steady cash flow. By having to repay its debts on a more consistent basis, a firm can sidestep large debt accumulations that may be difficult to pay off, especially during a business slump.

Reduced Interest and Inflation Risks

Another advantage of short debt maturation is lower exposure to interest rate and inflation risk. With long debt maturation, a company may be susceptible to changes in interest rates and inflation over an extended time, making debt management a difficult task.

For example, if interest rates surge during a long debt maturation, a company may struggle to repay its debts. This can significantly impact its cash flow and make it challenging to meet other financial obligations. However, if the company has a short debt maturation, its exposure to interest rate and inflation changes is reduced. Also, its debt obligations are spread over a shorter period.

Adaptable Debt Structure

Short debt maturation can lead to a more adaptable debt structure, allowing a company to quickly respond to market changes. With long debt maturation, a company may be locked into a fixed debt structure that is challenging to alter.

The Disadvantages of a Short Debt Maturity

The short debt maturity also has its drawbacks, including:

Higher Repayment Costs

One of the primary drawbacks of short-term debt is that it could increase immediate repayment expenses. This occurs because creditors might impose higher interest rates for short-term loans as they consider them a higher risk. Firms with limited funds could experience additional financial stress due to these elevated repayment costs, making debt management more challenging. To counterbalance the higher expenses of short-term debt, companies may need to renegotiate reduced coupon rates. Increasing short-term debt volume may not be a feasible solution for firms that have already accumulated considerable debt, as it would result in an unsustainable debt load.

Fluctuating Interest Rates and Cash Flow Issues

Another disadvantage of short-term debt is that it could result in more frequent fluctuations in interest rates. Interest rates can vary suddenly, and firms with a large short-term debt find it challenging when interest rates increase. This is particularly relevant for companies with restricted access to alternative funding sources. This is because, they may not be able to refinance their debt if interest rates rise rapidly. Furthermore, a sudden decline in cash flow could render a firm unable to repay its debts. Therefore, firms must contemplate their debt maturity profile and evaluate their ability to handle short-term debt before taking on additional debt. They should also consider the potential impact of interest rate fluctuations on their cash flow and be prepared to take measures to manage this risk if necessary.

Conclusion

The debt maturity profile presents both advantages and disadvantages, and it is crucial to weigh both ends of the spectrum. For a short debt maturity, there are the following benefits: improved financial stability, greater flexibility, and reduced vulnerability to inflation and interest rate risk. Despite these perks, a short debt maturity also has its shortcomings, such as more significant near-term repayment costs, more frequent interest rate fluctuations, and the possibility of a cash flow deficit. On the flip side, a long debt maturity profile has its advantages, such as stable debt repayment obligations, lower near-term repayment costs, and less susceptibility to interest rate fluctuations and inflation risk. However, a long debt maturity also presents a few drawbacks, such as reduced financial stability and decreased maneuverability in managing finances.