The definition of a Liquidity Plan is nothing less than creating an overview and a forecast of all company cash and account balances. [1] A solid Liquidity Plan is indispensable, especially for Startups. When a company goes out of liquidity, it can lead to insolvency, even though the order situation could be good, because profits in the future do nothing when you don’t have the money to pay the bills today.

To avoid falling into this trap, you should learn to do a Liquidity Plan as fast as possible. In this article, you will find everything you need to know to create a good Liquidity Plan

what is a Liquidity Plan

Liquidity comes from the Latin word liquidus, “liquid.” The term liquidity means how much money a company has in cash or Bank balances. [2] A company is liquid if it can pay the bills on time and without problems.

The Liquidity Plan represents the ability of a company to pay in the coming week, month, and year. It functions as an early warning system. When any financial bottlenecks are recognizable, it would still be possible to take countermeasures.

At the core, the Liquidity Plan is putting the expected income and outcome in a timeline and trying this as accurately as possible. All cashflows are inside the Liquidity Plan, i.e., the income of every employee, the payment for every stakeholder, or even the rent.

Don’t forget that you don’t need the money available immediately when the bill comes up. In most cases, a 30 days delay is expected and, in some branches, even more.

Why do you need a Liquidity Plan?

If you don’t give the Liquidity Plan definition and overview the attantion it needs, you will get very fast in serious trouble. Your first threat will be the dunning fees, and after that, your supplier will only accept to deliver your products if you pay in advance, which leads again to more troubles in case of your liquidity. You will start to get into a vicious circle, which leads to more loss of payments, and in the end, your suppliers will cut the relationship with you, and you can’t generate any revenue anymore. Your momentary payment bottleneck will lead to an emergency and unavoidable insolvency.

To avoid such a scenario, a Liquidity Plan isn’t lovely to have but necessary. Therefore, external financiers like banks will be very interested in this part of your Finance Planning. But don’t forget that even the best Liquidity Plan is only a forecast of your future account balance development. And everybody knows that even the best forecast can sometimes be wrong.

Constantly update your Liquidity Plan and compare them with the actual figures to keep an overview of everything inside the company. You always have to ask yourself how big the difference was and why the forecast didn’t happen. What does this mean for the future? If you keep doing this regularly, you will better understand your actual transactions and can make an even better Liquidity Plan next time.

Which numbers do you need for a Liquidity Plan?

The Liquidity Plan isn’t a big issue. In general, you have to take every cash-in on one side and the cash-out on the other side. That means every revenue, every Debt capital, and every Equity capital does influence the Liquidity and therefore comes in the Liquidity Plan. [3]

All outcome streams are defined in the following Positions:

- Investments

- Direct cost (like buying something, material, and packaging)

- Personal cost

- Operation expenses (like rent and insurance)

- Loan repayments

- Taxes

- Private withdrawal

Deprecations aren’t cash effective and, therefore, not relevant for the Liquidity Plan. That means you leave them out of your Liquidity Plan.

Special features of the Liquidity Plan

Your Liquidity Plan is the future statement of your account. Like every Plan, it is based on assumptions and comes with certain uncertainties. The more appropriate your presumptions, the more accurate you will be in your Liquidity Plan. But don’t be too harsh on yourself because perfect correspondence reality is almost impossible. It is essential to be honest with yourself and to feel the timeline when cash flow goes in or out.

Customers often pay days or even weeks after receiving the product or service. First, you write your Offer, then you get the Order, work on it, write the bill, and then it will take a month to get the actual cash into your account. It doesn’t make any difference to your Profit Planning if the money comes a month or two after what you expected because it only needs the cash before the end of the year. Still, for your Liquidity Plan, it is a massive issue because your timeline between order placement and income payment isn’t correct anymore.

Where to pay attention to when creating a Liquidity Plan

For the first Liquidity Plan, you shouldn’t make it too complicated. The definition of your first Liquidity Plan should be to start an overview that covers all income and outcome streams for the upcoming months. Don’t forget to try to calculate the expected amount as accurately as possible and when this amount is expected.

Before starting the liquidity plan, you should consider basic things, like how many employees you have, which investments will come up, and how the revenue will evolve. The more accurate your question is, the more accurate your Liquidity Plan.

While the monthly costs are easy to determine, the monthly income is slightly more complicated. The rule of thumb is: Be always more careful and be happy if your finance evolves better than expected. You will save yourself from payment bottlenecks and be more trustworthy to your supplier.

Automate your Liquidity Plan reporting

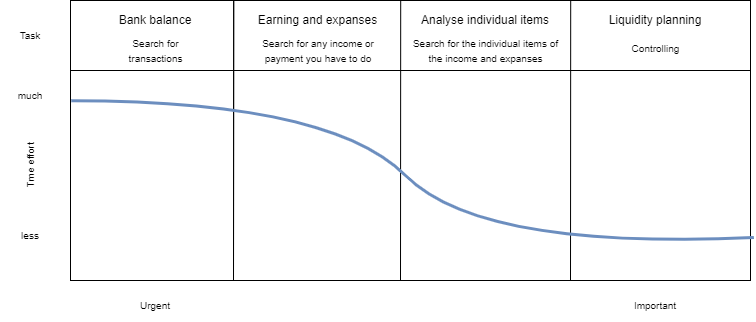

Creating a Liquidity Plan involves several steps and requires specific data to be extracted, transformed, and loaded into the plan. Here is an overview of the ETL process for creating a Liquidity Plan:

Extract

To create a Liquidity Plan, you must gather data about your company’s cash and account balances, expected income and outcome streams, and other relevant financial information. This data can be extracted from various sources such as accounting software, bank statements, invoices, and financial reports.

Transform

Once the data is extracted, it must be transformed into a format compatible with the Liquidity Plan. This may involve converting currencies, aggregating data, and calculating expected amounts and dates of payment for each income and outcome stream.

Load

The final step is to load the transformed data into the Liquidity Plan. This involves inputting the data into a timeline and categorizing it based on income and outcome streams. The plan should include all cash flows, including investments, direct costs, personal costs, operation expenses, loan repayments, taxes, and private withdrawals.

Conclusion

The Liquidity Plan plays a significant role in your company’s future planning. The definition of the Liquidity Plan is to give you an overview of how your abilities to pay in the future.

It is simple to create a solid Liquidity Plan. Suppose you constantly review your cashflows and not only pay attention to the value but instead, you also observe the timeline of when the money gets in or out. In that case, you are already in a good position for the future because you will be able to counteract if there are any bottlenecks.

Unable to pay, even for some time, can have enormous consequences. The trust between you and your supplier will be damaged, you will get a bad score at the banks, and your employees can have privacy issues.

This experience can be easily avoided when creating a good Liquidity Plan.