Signatures

Optimizing Processes with Digital Signatures The banking, financial services, and insurance sector (BFSI) faces a rapidly shifting paradigm. As digitalization advances, financial organizations are seeking novel methods to simplify their procedures, amplify productivity, and enhance the customer experience. One such innovative solution is Adobe Sign, Adobe’s cloud-based e-signature platform. This article delves into the advantages of Adobe Sign for BFSI and how it helps financial institutions remain at the forefront of digital transformation.

What is Adobe Sign?

Adobe Sign is a cloud-based e-signature platform that allows organizations to sign, send, monitor, and manage signature-based transactions electronically with complete security. It seamlessly integrates with existing systems, workflows, and processes to streamline signature-based transactions, reducing the time required and increasing efficiency. Using Adobe Sign, financial institutions can securely sign, send, and manage contracts, loan applications, and other critical documents.

Why is Adobe Sign Important for BFSI?

Adobe Sign is critical for BFSI as it helps financial institutions stay ahead in the digital age. By streamlining signature-based transactions, it saves time, increases efficiency, and provides a better customer experience. Financial institutions can securely sign, send, and manage contracts, loan applications, and other critical documents, mitigating the risk and delays.

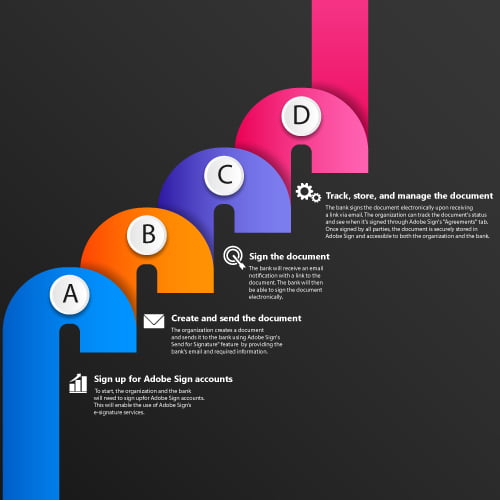

How does Adobe Sign work?

Adobe Sign operates by integrating with existing systems, workflows, and processes. It is intuitive and user-friendly, with a straightforward interface. Once integrated, Adobe Sign enables financial institutions to smanage signature-based transactions electronically, minimizing the risk of errors and delays. With real-time monitoring, financial institutions can track the status of their signature-based transactions, ensuring they are completed on time and accurately.

Features of Adobe Sign

Adobe Sign boasts many features that make it an ideal solution for BFSI. Some of the crucial features are:

Secure Signing

The security of confidential information is a top priority for Adobe Sign. That’s why it employs the highest level of security, including encryption. The encryption process ensures that all sensitive information remains confidential and protected from unauthorized access. This increased security helps financial institutions maintain customer trust and protect sensitive information.

Workflow Automation

Adobe Sign automates signature-based transactions, making it easier for financial institutions to manage and complete them. The automation process makes the process faster, ensuring that all signature-based transactions are completed accurately and on time. This improved efficiency leads to cost savings and increased profitability for financial institutions.

Real-Time Monitoring

Financial institutions can monitor the status of their signature-based transactions in real time with Adobe Sign. The real-time monitoring feature ensures that all signature-based transactions are trackable and enables appropriate action if any issues occur. This increased visibility and better customer experience.

Mobile Accessibility

Adobe Sign is accessible from any device, including smartphones and tablets, making it easy to sign and manage signature-based transactions. Financial institutions can access Adobe Sign from anywhere and anytime, leading to increased flexibility and convenience. This increased accessibility helps financial institutions provide a better customer experience, making it easier for customers to manage transactions.

Integrations

Adobe Sign integrates with existing systems, workflows, and processes, making it easy to use and streamline signature-based transactions. With seamless integrations, financial institutions can work more efficiently and save time, as they don’t have to switch between multiple systems to manage signature-based transactions. This increased efficiency leads to cost savings and increased profitability.

Implementing Adobe Sign in BFSI

Implementing Adobe Sign in the BFSI domain necessitates astute preparation and seamless execution. Financial organizations must collaborate with Adobe Sign specialists to ensure a flawless integration with existing systems, procedures, and workflows. This incorporates setting up the platform, configuring workflows, and training employees in the utilization of the system.

Enhancing Customer Experience with Adobe Sign

Adobe Sign bolsters financial organizations in enhancing the customer experience by furnishing a secure and effortless way to sign, dispatch, and manage signature-based transactions. With Adobe Sign, customers can sign and regulate their documents whever they like. This improved accessibility and convenience can enhance customer satisfaction and foster loyalty.

ROI of Adobe Sign for BFSI

Adobe Sign can provide financial organizations with a substantial return on investment by streamlining signature-based transactions, saving time and resources while boosting efficiency and customer satisfaction. Furthermore, the heightened security and adaptability offered by Adobe Sign can aid financial organizations in save money.

Enhancing Compliance with Adobe Sign for BFSI

Adobe Sign for BFSI empowers financial organizations in augmenting their compliance with industry regulations and standards. By employing a secure and tamper-proof platform for signature-based transactions, financial organizations can guarantee the confidentiality and protection of their customers’ sensitive information. Adobe Sign also furnishes a comprehensive audit trail of all signature-based transactions, assisting financial organizations in preserving an accurate and complete record of their activities.

Enhancing Productivity with Adobe Sign

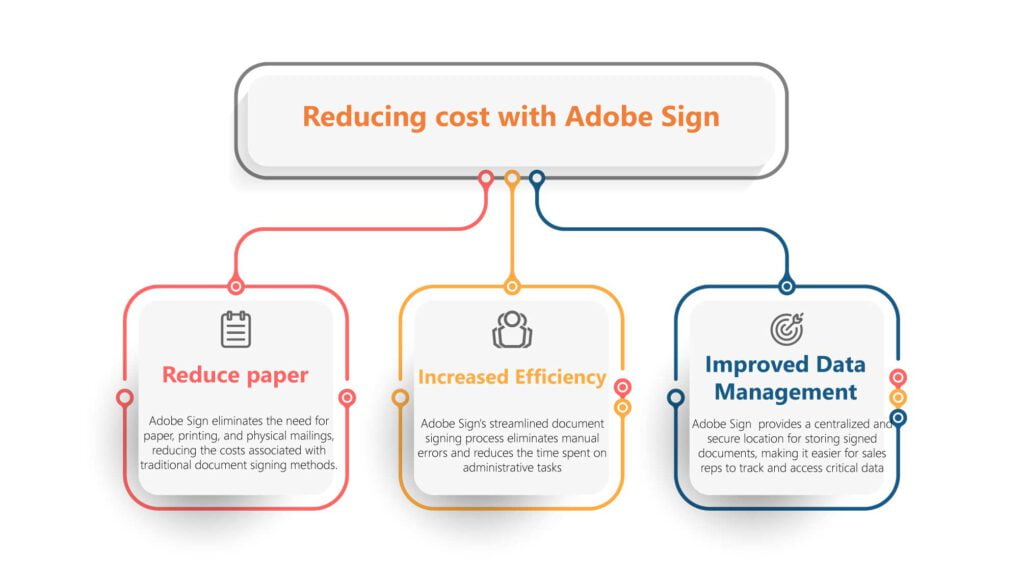

Adobe Sign can enhance the productivity of financial organizations by automating signature-based transactions, reducing manual labor and freeing up employees to focus on more critical tasks. Additionally, Adobe Sign eliminates the need for physical signatures, saving time and resources associated with printing, mailing, and scanning of documents.

Benefits of Adobe Sign for BFSI

Adobe Sign offers a range of benefits for financial institutions, which makes it a popular solution in the BFSI sector. Some of the benefits are:

Improved Efficiency

By streamlining signature-based transactions, Adobe Sign helps financial institutions save time and increase efficiency. The automation process minimizes the risk of errors and delays, ensuring that all signature-based transactions are completed accurately and on time. This improved efficiency leads to cost savings and increased profitability for financial institutions.

Better Customer Experience

Adobe Sign provides a better customer experience by enabling financial institutions to securely sign, send, and manage contracts, loan applications, and other critical documents. The secure signing process makes it easier for financial institutions to maintain customer trust, which leads to a better customer experience. With mobile accessibility, customers can sign and manage signature-based transactions anywhere and at any time, leading to increased convenience and flexibility.

Increased Security

Adobe Sign uses the highest level of security, including encryption, to protect sensitive information. This increased security helps financial institutions maintain customer trust and keep sensitive information confidential. This increased security leads to better customer experience and increased customer trust.

Cost Savings

By reducing the risk of errors and delays, Adobe Sign helps financial institutions save money and increase profitability. Automation minimizes the risk of errors and delays, leading to cost savings and increased profitability. Financial institutions can also save time and resources with improved efficiency, leading to increased profitability.

Increased Flexibility

Adobe Sign is accessible from any device, including smartphones and tablets, making it easy to sign and manage signature-based transactions. This increased flexibility allows financial institutions to provide a better customer experience by making it easier for customers to sign and manage signature-based transactions from anywhere and at any time.

Customizing Adobe Sign Workflows for BFSI

Financial organizations can customize Adobe Sign workflows to align with their unique needs and processes, including configuring signature workflows, establishing document templates, and defining signature policies. Adobe Sign provides numerous customization options, such as custom branding, to further personalize the platform to meet the specific requirements of financial organizations.

Collaborating with External Parties

In real-time, Adobe Sign enables financial organizations to collaborate with external entities, such as customers, vendors, and partners. Its user-friendly platform allows financial organizations to send documents for signature, track signature requests, and receive signed documents, all from within a single secure platform. This accelerates the speed and efficiency of signature-based transactions and grants financial organizations control over the signing process.

Integration with Other Applications

Adobe Sign can integrate with many applications, including customer relationship management (CRM) systems, enterprise resource planning (ERP) systems, and other crucial business applications. This streamlines operation and increases efficiency by integrating signature-based transactions into existing workflows for financial organizations.

Ensuring Security with Adobe Sign

Adobe Sign implements sophisticated security measures to guarantee the confidentiality of customer data and ensure privacy. The platform rests on a sturdy, dependable foundation, and every transaction is encrypted using state-of-the-art SSL protocols. Furthermore, Adobe Sign furnishes comprehensive audit trails of all signature-based dealings, thereby aiding financial institutions in identifying and addressing any potential security hazards.

Improving the Customer Experience

Adobe Sign transforms the customer experience by delivering a fast, uncomplicated and convenient way for clients to sign documents. Its intuitive and user-friendly interface permits customers to sign documents from any place, at any time, on any device, enhancing the customer experience and fostering stronger relationships with clients.

Increasing Revenue with Adobe Sign

Adobe Sign enhances financial institutions’ profits by lowering costs, optimizing operational proficiency, and transforming the customer journey. By automating signature-based dealings, financial institutions can save time and minimize manual labor, freeing up employees to focus on more strategic endeavors. Additionally, by offering a quicker and more convenient way for clients to sign documents, Adobe Sign can boost customer satisfaction and loyalty, leading to increased customer retention and repeat business.

Staying Ahead of the Competition with Adobe Sign

Adobe Sign empowers financial institutions to stay ahead of the curve by providing a comprehensive e-signature solution that keeps pace with the rapidly changing digital arena. With its capacity to streamline processes, augment efficiency, and enhance compliance, Adobe Sign is an indispensable tool for financial institutions striving to remain competitive in today’s dynamic business environment.

Conclusion

Adobe Sign for BFSI is a powerful, flexible e-signature solution that confers financial institutions with a wealth of benefits including optimized efficiency, improved compliance, enhanced security, and transformed customer experience. Whether you’re looking to streamline your operations, maximize revenues, or stay ahead of the competition, Adobe Sign is a critical tool that can help you reach your goals.